Time ▾ Price ▴ Research

Friday, April 26, 2024

S&P 500 Cycle Analysis | Steve Miller

Labels:

Cycle Analysis,

J.M. Hurst,

S&P 500,

Steve Miller,

US-Stocks

Does history make a case that Bitcoin has topped? | Peter L. Brandt

Judge for yourself. It’s called Exponential Decay — and it describes Bitcoin. I hate being the bearer of bad news, but data are data. The fact is that the bull market cycles in Bitcoin have lost a tremendous amount of thrust over the years. You may like the story of this data or not — but you will have to deal with it (or at least account for it, adjust for it or just plain ignore it). In fact, I don’t like the Exponential Decay occurring in Bitcoin — Bitcoin is one of my personal largest investment positions.

There have been four major bull cycles in Bitcoin, with the current advance the fifth major bull cycle [the advance from cycle low to cycle high shown in brackets].

Now, here is where Exponential Decay is showing its ugly head.

Worded another way, 80% of the exponential energy of each successful bull market cycle has been lost. Applied forward, this would indicate that the current bull cycle will experience an an exponential advance of approximately 4.5X or so (80% of the 22X of the 2018-2021 cycle). Taking a low for the current cycle of $15,473 projects a high for this cycle of $72,723 — guess what — a price that has already been reached.

Well, you will ask, what about the halving? Prices have exploded upwards after every previous halving. And that may happen again. But for now we need to deal with the fact of Exponential Decay. It has happened. It is real. You may not want to believe it, but I place a 25% chance that Bitcoin has already topped for this cycle.

If Bitcoin has topped, what’s next you might ask. Of course I have no clue. But, if Bitcoin has topped I would expect a decline back to the mid-$30s, or the 2021 lows. From a classical charting point of view, such a decline is the most bullish thing that could happen from a long-term view. If you want to see an example of such a chart structure, look at the Gold chart from Aug 2020 to Mar 2024.

Do I believe the analysis just presented? I don’t want to, but the data speak for itself.

There have been four major bull cycles in Bitcoin, with the current advance the fifth major bull cycle [the advance from cycle low to cycle high shown in brackets].

Dec 21, 2009 to Jun 6, 2011 [3,191X advance]

Nov 14, 2011 to Nov 25, 2013 [572X advance]

Aug 17, 2015 to Dec 18, 2017 [ 122X advance]

Dec 10, 2018 to Nov 8, 2021 [ 22X advance]

Nov 21, 2022 to xxx x,, yyyy [high so far is $73,835 registered on Mar 14, 2024]

Nov 14, 2011 to Nov 25, 2013 [572X advance]

Aug 17, 2015 to Dec 18, 2017 [ 122X advance]

Dec 10, 2018 to Nov 8, 2021 [ 22X advance]

Nov 21, 2022 to xxx x,, yyyy [high so far is $73,835 registered on Mar 14, 2024]

Now, here is where Exponential Decay is showing its ugly head.

The magnitude of the 2011-2013 was approx. 20% of the 2009-2011 cycle

The magnitude of the 2015-2017 was approx. 20% of the 2011-2013 cycle

The magnitude of the 2018-2021 was approx. 20% of the 2015-2017 cycle

The magnitude of the 2015-2017 was approx. 20% of the 2011-2013 cycle

The magnitude of the 2018-2021 was approx. 20% of the 2015-2017 cycle

Worded another way, 80% of the exponential energy of each successful bull market cycle has been lost. Applied forward, this would indicate that the current bull cycle will experience an an exponential advance of approximately 4.5X or so (80% of the 22X of the 2018-2021 cycle). Taking a low for the current cycle of $15,473 projects a high for this cycle of $72,723 — guess what — a price that has already been reached.

Well, you will ask, what about the halving? Prices have exploded upwards after every previous halving. And that may happen again. But for now we need to deal with the fact of Exponential Decay. It has happened. It is real. You may not want to believe it, but I place a 25% chance that Bitcoin has already topped for this cycle.

If Bitcoin has topped, what’s next you might ask. Of course I have no clue. But, if Bitcoin has topped I would expect a decline back to the mid-$30s, or the 2021 lows. From a classical charting point of view, such a decline is the most bullish thing that could happen from a long-term view. If you want to see an example of such a chart structure, look at the Gold chart from Aug 2020 to Mar 2024.

Do I believe the analysis just presented? I don’t want to, but the data speak for itself.

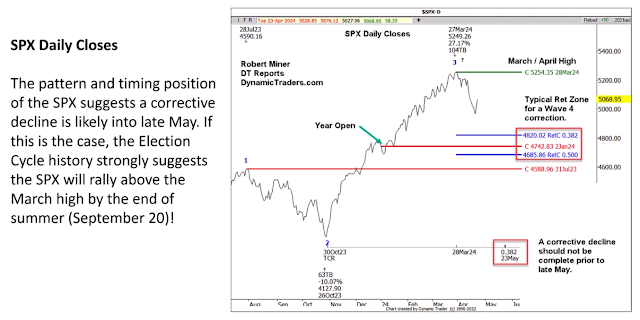

The S&P 500 and the Election Year Cycle | Robert Miner

I am recording this on April 25th and am going to talk about the S&P 500 and the election cycle today. [...] Within the next three weeks there is going to be one of the best setups within the entire election cycle. This is a setup that since 1952 had only one minor losing year (less than -1%).

In the above chart the dark black line is the average of all election years since 1952. The gray line is the average of all election years since 1984. The red line is 2024 up to past week.

[...] The second chart just covers the beginning of March through September period of the election years. The blue line is the average of all election years since 1952. In the first chart we saw the entire year, where the first part of the year is usually fairly negative. On average, we can see this distinct dip into the middle of May.

[...] Here are just two key pieces of information from the election year study from the spring until the end of summer. Number one, the 'summer low' is usually made around the second half of May to the first half of June. So that summer low probably hasn't been made yet. It sort of implies that the S&P is likely to be sideways to down into the second half of May. At least that is based on the averages of election years. Number two, in every election year, when the first quarter was strongly bullish (which it was in 2024), the S&P traded above the March high by September 20th - except for the year 2000, when the summer high came within just seven points of the March high by September 20th.

If the S&P happens to be sideways to down for the next few weeks, we know that the bias is overwhelmingly strong and bullish and that the S&P should then trade above the March high before September 20th. The March high was the high of the year so far, and it is more than likely that the S&P will go sideways to down in the next few weeks. A correction would not be complete prior to May 23rd to 38% time retracement.

[...] The second chart just covers the beginning of March through September period of the election years. The blue line is the average of all election years since 1952. In the first chart we saw the entire year, where the first part of the year is usually fairly negative. On average, we can see this distinct dip into the middle of May.

[...] Here are just two key pieces of information from the election year study from the spring until the end of summer. Number one, the 'summer low' is usually made around the second half of May to the first half of June. So that summer low probably hasn't been made yet. It sort of implies that the S&P is likely to be sideways to down into the second half of May. At least that is based on the averages of election years. Number two, in every election year, when the first quarter was strongly bullish (which it was in 2024), the S&P traded above the March high by September 20th - except for the year 2000, when the summer high came within just seven points of the March high by September 20th.

If the S&P happens to be sideways to down for the next few weeks, we know that the bias is overwhelmingly strong and bullish and that the S&P should then trade above the March high before September 20th. The March high was the high of the year so far, and it is more than likely that the S&P will go sideways to down in the next few weeks. A correction would not be complete prior to May 23rd to 38% time retracement.

Labels:

Cycles,

Presidential Cycle,

Price Action,

Robert Miner,

S&P 500,

Seasonality,

Time-Price Correlation,

US-Stocks

Thursday, April 25, 2024

Algo vs DJIA | Handler & Associates, Inc.

Labels:

DJIA,

Handler & Associates,

Inc.,

US-Stocks

Wednesday, April 24, 2024

S&P 500 Strength into May 1 & Weakness through Mid May | Larry Williams

Larry Williams expects U.S. stock market strength through May 1 (Wed) and weakness to follow through the middle of May.

That weakness could be followed by a relief rally into early June, then another leg down in July. “I am heavily short here,” he says. He expects a strong end of the year as a rally gets under way in early September.

Quoted from:

MarketWatch (April 23, 2024) - Ralph Acampora, Larry Williams and Vance Howard see market weakness ahead.

MarketWatch (April 23, 2024) - Ralph Acampora, Larry Williams and Vance Howard see market weakness ahead.

Labels:

Cycles,

Larry Williams,

S&P 500,

Swing Trading,

Technical Analysis,

US Stocks

Monday, April 15, 2024

Top Reasons to Exit S&P Short Positions Soon | Allen Reminick

The S&P market has been behaving as expected. It looks as if April 15 (Mon) or so could be a low followed by a bounce for a few days until April 18 (Thu) followed by another decline into the April 24 (Wed).

Apr 15 (Mon) Major Low ?

Apr 18 (Thu) High

Apr 23-24 (Tue-Wed) Low

Apr 18 (Thu) High

Apr 23-24 (Tue-Wed) Low

Bounce

May 9 (Thu) Major Low ?

May 9 (Thu) Major Low ?

May 24 (Fri) Major High

Jul 24 (Wed) Major Low

Jul 24 (Wed) Major Low

Today is April 14 (Sun) and we're looking at this forecast as being very

similar. But there are several different variations of this particular

pattern. The most reliable one so far has been the year 2000 market. It is

repeating almost exactly what happened in April of 2000 and that low

came in on April 14. But we are looking for a low around April 23-24 (Tue-Wed), another bounce and another low around May 9 (Thu). The May 9th

low may not be lower than the market is right now.

The analogs we're using are the year 2000, the 1996 market and the 2006 market. All of which are connected to the present market and you can see the overlap of the 1996 and the 2006 markets and how they go forward is extremely similar but not identical.

They both have a high late May, they both have a low late July. But from now until late May they have different variations on how they go forward. So at this point one needs to be cautious about expecting continued lower prices because the fourth wave does not have to be a big decline. It's after the Elliott fifth wave that you'd expect to see a major decline.

The analogs we're using are the year 2000, the 1996 market and the 2006 market. All of which are connected to the present market and you can see the overlap of the 1996 and the 2006 markets and how they go forward is extremely similar but not identical.

They both have a high late May, they both have a low late July. But from now until late May they have different variations on how they go forward. So at this point one needs to be cautious about expecting continued lower prices because the fourth wave does not have to be a big decline. It's after the Elliott fifth wave that you'd expect to see a major decline.

After this whole correction phase is over we're

expecting a new high by May 24 (Fri), a strong rally in the month of May and

then after that a very big decline from May 24 (Fri) down into July 24 (Wed) area. That could be a very significant short position for those who want

to go short or at least one once a hedge, one's long positions during

that time. After that July low the market should again rebound strongly and by the end of the year make new highs.

So we're looking at a fourth wave correction which is probably going to end either in the next two weeks or it could be as late as May 9 (Thu) and then the fifth wave rally until late May followed by an ABC meaningful correction of the whole move from October 27th until May 24th that whole up move should be corrected in the two months after that. So if you're looking for a big decline it's not likely to happen now. It's more likely to happen after the end of May.

So we're looking at a fourth wave correction which is probably going to end either in the next two weeks or it could be as late as May 9 (Thu) and then the fifth wave rally until late May followed by an ABC meaningful correction of the whole move from October 27th until May 24th that whole up move should be corrected in the two months after that. So if you're looking for a big decline it's not likely to happen now. It's more likely to happen after the end of May.

Labels:

Allen Reminick,

Cycles,

Elliott Wave,

Financial Astrology,

S&P 500 Index,

Seasonality,

Tom McClellan,

US-Stocks

Friday, April 12, 2024

S&P 500 Bear Reversal - Gann's Time and Price Overbalance | Robert Miner

YM and RTY have already made Bear Reversal Signal. S&P and NQ should soon confirm. Gann's time and price overbalance signals: A daily close below 5283 would be an 'overbalance of price' and strong signal the trend should be net Bear for 3-4 weeks or longer.

Labels:

Robert Miner,

S&P 500,

US-Stocks,

W.D. Gann

Wednesday, April 3, 2024

ICT Syllabus for Beginners - How to Study ICT on YouTube | Darya Filipenka

This is my personal recommendation to study the ICT YouTube channel. I truly believe that this information is enough to understand how the ICT concepts works.

Part 1:

2. Real Money Real Results - First Year Trading Expectations - Part 2 of 3

3. Real Money Real Results - First Year Trading Expectations - Part 3 of 3

3. Real Money Real Results - First Year Trading Expectations - Part 3 of 3

Part 2:

1. ICT Mentorship Core Content - Month 01 - Elements Of A Trade Setup

2. ICT Mentorship Core Content - Month 02 - Growing Small Accounts

3. ICT Mentorship Core Content - Month 03 - Timeframe Selection & Defining Setups

4. ICT Mentorship Core Content - Month 04 - Interest Rate Effects On Currency Trades

2. ICT Mentorship Core Content - Month 02 - Growing Small Accounts

3. ICT Mentorship Core Content - Month 03 - Timeframe Selection & Defining Setups

4. ICT Mentorship Core Content - Month 04 - Interest Rate Effects On Currency Trades

After Month 4:

After Month 7:

9. ICT Mentorship Core Content - Month 09 - The Sentiment Effect

10. ICT Mentorship Core Content - Month 10 - Commitment Of Traders

11. ICT Mentorship Core Content - Month 11 - Commodity Mega-Trades

12. ICT Mentorship Core Content - Month 12 - Long Term Top Down Analysis

10. ICT Mentorship Core Content - Month 10 - Commitment Of Traders

11. ICT Mentorship Core Content - Month 11 - Commodity Mega-Trades

12. ICT Mentorship Core Content - Month 12 - Long Term Top Down Analysis

Part 3:

1. ICT Institutional Price Action - Micro-Market Structure & Time & Price Concepts

2. ICT Forex - What New Traders Should Focus On

3. ICT Charter Price Action Model 9 - One Shot One Kill

4. ICT Charter Price Action Model 9 - One Shot One Kill Trade Plan & Algorithmic Theory

2. ICT Forex - What New Traders Should Focus On

3. ICT Charter Price Action Model 9 - One Shot One Kill

4. ICT Charter Price Action Model 9 - One Shot One Kill Trade Plan & Algorithmic Theory

Part 4:

1. ICT Mentorship 2022 Introduction + ICT Mentorship 2023 - Algorithmic Price Delivery & Time Macros Intro

2. 2023 ICT Mentorship - Opening Range Gap Repricing Macro

3. ICT Forex - Understanding The ICT Judas Swing

4. ICT Mentorship 2023 - Deep Dive Into Institutional Order Flow

2. 2023 ICT Mentorship - Opening Range Gap Repricing Macro

3. ICT Forex - Understanding The ICT Judas Swing

4. ICT Mentorship 2023 - Deep Dive Into Institutional Order Flow

Part 5:

Market Maker Models

1. ICT Charter Price Action Model 6 - Amplified Lesson

2. ICT Charter Price Action Model 6.2 - Amplified Lesson

3. ICT Charter Price Action Model 6 - Universal Trading Model

2. ICT Charter Price Action Model 6.2 - Amplified Lesson

3. ICT Charter Price Action Model 6 - Universal Trading Model

ICT Trading on NFP and FOMC Days | Darya Filipenka

» We wait for that initial run.

I don't care if it goes higher or lower.

I do know that the first run is generally the fake move.

It's like a Judas swing.

And then they keep it where it ran to. «

Reference:

Darya Filipenka (March 20, 2024) @ Twitter/X

Michael J. Huddleston (July 8, 2023) - Trading Taboo Days: NFP, FOMC & Mondays (video)

Darya Filipenka (March 20, 2024) @ Twitter/X

Michael J. Huddleston (July 8, 2023) - Trading Taboo Days: NFP, FOMC & Mondays (video)

Labels:

Darya Filipenka,

Day Trading,

External Range Liquidity,

FOMC,

ICT,

Internal Range Liquidity,

Judas Swing,

Michael J. Huddleston,

NFP

Monday, April 1, 2024

Solunar Rhythm, Cosmic Cluster Days & Sensitive Sun Degrees | April 2024

The SoLunar Rhythm in April 2024.

[ oftentimes true : ]

In Bull Markets, New Moons are Bottoms, and Full Moons are Tops.

In Bear Markets, New Moons are Tops, and Full Moons are Bottoms.

ooo0ooo

ooo0ooo

Mar 16 (Sat)

Apr 04 (Thu)

Apr 07 (Sun)

Apr 15 (Mon)

Apr 21 (Sun)

Apr 26 (Fri)

May 15 (Wed)

Apr 04 (Thu)

Apr 07 (Sun)

Apr 15 (Mon)

Apr 21 (Sun)

Apr 26 (Fri)

May 15 (Wed)

2024 03 31 (Sun) = SUN @ 11 ARI = 11 degrees positive

2024 04 07 (Sun) = SUN @ 18 ARI = 18 degrees negative

2024 04 13 (Sat) = SUN @ 24 ARI = 24 degrees negative

2024 04 26 (Fri) = SUN @ 6 TAU = 36 degrees negative

2024 05 01 (Wed) = SUN @ 12 TAU = 42 degrees neutral

2024 04 07 (Sun) = SUN @ 18 ARI = 18 degrees negative

2024 04 13 (Sat) = SUN @ 24 ARI = 24 degrees negative

2024 04 26 (Fri) = SUN @ 6 TAU = 36 degrees negative

2024 05 01 (Wed) = SUN @ 12 TAU = 42 degrees neutral

Labels:

Chinese 24 Solar Terms,

Cosmic Cluster Days,

Financial Astrology,

Lunar Cycle,

Sensitive Degrees of the Sun,

Solunar Rhythm

The Path of the Moon's Shadow during the April 8 Total Solar Eclipse

During the Great North American Total Solar Eclipse on April 8 (a Monday) 2024 the path of totality of the Moon's shadow runs northeast across the Pacific Ocean, Sinaloa, Texas, Upstate New York, Newfoundland, the Labrador Sea, and the North Atlantic Ocean. For some moment Nazas in Durango will be the darkest place on Earth. And the invisible true lunar nodes are performing their particular choreography again.

Friday, March 29, 2024

Crude Oil's 10-Year Leading Indication for US Stock Market | Tom McClellan

One of the big picture forecasting tools is crude oil prices as a leading indication for the overall stock market. The first chart shows crude oil prices back to 1890 compared to the Dow Jones Industrial Average plotted on logarithmic scales. The price of crude oil is shifted forward by 10 years. The correlation isn't always perfect, but generally speaking, when there is a rise in crude oil prices, 10 years later, there is a rise in the stock market. When crude oil prices go flat, the stock market goes flat.

We are not

yet quite at that 10 year echo point in stocks, which would equate to

June of 2024, 10 years after crude oil peaked. That means the next few years are not going to be so great, especially

between now and early 2026. Early 2026 will be a great time for investors

to ride the stock market long all the way to 2028.

Labels:

Correlation,

Crude Oil,

Decennial Cycle,

Decennial Pattern,

Presidential Cycle,

S&P 500,

Seasonality,

Tom McClellan,

US Stocks

Wednesday, March 27, 2024

ICT Silver Bullet Strategy | Darya Filipenka

The ICT Silver Bullet Strategy is a time-based algorithmic trading model for all assets. For the 10 AM Silver Bullet strategy, focus on 10-11 AM, using fair value gaps and Fibonacci levels for entry/stop adjustments, aiming for a minimum 3R risk-reward, and exit by 11 AM to maximize profits and minimize risks.

3:00 AM - 4:00 AM New York Time

- A Silver Bullet trade begins with a directional move either up or down.

- Fair Value Gap (FVG): After the directional move, a Fair Value Gap is left behind. This gap is an important indicator for the Silver Bullet trade.

- Market Structure Shift (MSS) after taking liquidity. A Market Structure Shift is a shift in direction of price delivery. When price is going in a direction and shifts to the exactly opposite. It occurs when price takes out previous short-term lows or highs within a trend. Identifying these shifts allows for an understanding on which side of the market to be trading with. A Market Structure Shift must be energetic and leave behind displacement to ensure that market is looking to reverse.

- Displacement is a location in price where someone with a lot of money comes into the marketplace with a strong conviction to move price higher or lower very quickly. Displacement is characterized by strong and quick price movement that leave behind Fair Value Gaps.

- Entering the Fair Value Gap: Once the Fair Value Gap is identified, we enter inside it. This means we take a position in the market.

- Target and Exit: I aim for Asian Session Liquidity Level or Higher Time Frame Premium/Discount levels.

The first thing we think about is the previous New York PM session. If, within the first 30 minutes after the market opens, we're not close to the PM range, we focus on the London Session Raid. This refers to the time between 2:00 AM and 5:00 AM, which is shown on the ETH chart. During the first 30 minutes after the market opens at 9:30 AM, we check where we stand compared to the previous PM session or London session. The market might go up or down, or it might stay stable. Then we wait for the Displacement between 10:00 AM and 11:00 AM, which sets the stage for the Silver Bullet setup.

- Every day between 10 AM and 11 AM EST, identify an obvious pool of liquidity that has not been tapped into or engaged.

- Wait for displacement (use 1-3-5 minute charts) towards liquidity pool between that time. Find a Fair Value Gap (FVG) on the opposite of the targeted liquidity pool.

- Wait for price to trade back into the Fair Value Gap and then reprice out of the FVG towards the targeted pool of liquidity.

2:00 PM - 3:00 PM New York Time

The first thing we focus on is the morning and lunch time trading sessions. Our goal is to identify the AM Session Buy Side and Sell Side Liquidity (BSL/SSL) or Lunch BSL/SSL once the PM Session starts (from 1:30 PM to 4:00 PM). This will serve as our reversal point during the afternoon Silver Bullet, where our target will be the opposite liquidity of the lunch/AM session. If it's Friday, our target can be 20-30% of the weekly range. This is known as the T.G.I.F. setup according to ICT.

- We wait for the Displacement between 2 PM and 3 PM EST, which sets the stage for the Silver Bullet setup.

- We look for a clear pool of untapped liquidity. It's recommended to pay attention to the liquidity levels during the AM and Lunch sessions.

- Find a Fair Value Gap.

- Wait for the price to trade back into the FVG and then move out of the FVG towards the targeted pool of liquidity.

Consider the 6 hour, the 90 minute, and the 22.5 minute cycles.

Expect highs and lows on the 1 minute chart around Micro-Quarter turns.

Reference:

Darya Filipenka (2024) - ICT Market Maker Buy Model and Sell Model (MMXM).

Darya Filipenka (2024) - Quarterly Theory - London and New York AM & PM Setups.

Darya Filipenka (2024) - Quarterly Theory - London and New York AM & PM Setups.

Labels:

22.5 Minute Cycle,

6 Hour Cycle,

90 Minute Cycle,

Algorithmic Pricing,

Darya Filipenka,

Day Trading,

ICT,

Michael J. Huddleston,

Quarterly Market Maker Cycle,

Quarterly Theory,

Silver Bullet Strategy

Monday, March 25, 2024

Prepare for April S&P Correction Now │ Allen Reminick

Short term, the S&P market is topping in the next two weeks.

We've been discussing the 18 year cycle and the 12 year cycle and the 24 year cycle, all having agreement since March 12th, where they all implied that the market would rally until Monday, March 25th or longer. There is a very good chance that is the beginning of a sideways phase that could last until as late as April 10th. We're not expecting a dramatic continuation on the upside. Potentially the market goes slightly higher between now and April 10th, but it's a topping phase.

We've been discussing the 18 year cycle and the 12 year cycle and the 24 year cycle, all having agreement since March 12th, where they all implied that the market would rally until Monday, March 25th or longer. There is a very good chance that is the beginning of a sideways phase that could last until as late as April 10th. We're not expecting a dramatic continuation on the upside. Potentially the market goes slightly higher between now and April 10th, but it's a topping phase.

It's a down, up, down, up, down, up kind of pattern. And finally, in the later part of April, it should make a low. Between April 16th and the 24th of April. But it may gyrate and just do nothing much until it's ready to fall between April 10th and April 24th.

After that, of course, we're expecting to see further, higher prices until May 23rd , between 5,400 and 5,600. This could be completing the move that started October 27th of 2023.

Sunday, March 24, 2024

S&P 500 March-April 2024 Seasonality │ Jeff Hirsch & Wayne Whaley

After 5 months of solid gains, are markets ready for a pause? Bullish Presidential Cycle Sitting President Pattern flattens out the mid-February to late-March seasonal retreat considerably without 2020 in the average.

April is the final month of the “Best Six Months” for DJIA and the S&P 500. From our Seasonal MACD Buy Signal on October 9, 2023, through (March 21, 2024), DJIA is up 18.4% and S&P 500 is up 20.9%. Fueled by interest rate cut expectations and AI speculation, these gains are approximately double the historical average already and could continue to increase before the “Best Months” come to an end.

'Best Six Months' ends in April.

April is the final month of the “Best Six Months” for DJIA and the S&P 500. From our Seasonal MACD Buy Signal on October 9, 2023, through (March 21, 2024), DJIA is up 18.4% and S&P 500 is up 20.9%. Fueled by interest rate cut expectations and AI speculation, these gains are approximately double the historical average already and could continue to increase before the “Best Months” come to an end.

This AI-fueled bull market has enjoyed solid gains since last October and will likely continue to push higher in the near-term, but momentum does appear to be waning with the pace of gains slowing. With April and the end of DJIA’s and S&P 500’s “Best Six Months” quickly approaching we are going to begin shifting to a more cautious stance. We maintain our bullish stance for 2024, but that does not preclude the possibility of some weakness during spring and summer.

THE CORRELATION MODEL SEES A NEGATIVE LAST WEEK OF MARCH FOR THE S&P. Provided a time frame of interest, my correlation model calculates the Correlation Coefficients (-1 to +1) for the past performance of 4165 different time frames over the prior 3 months vs the performance for the time frame of interest in search of the period which has demonstrated the most barometric acumen in predicting the performance of the upcoming time frame of interest.

This week I ask the model for it’s prognosis for the S&P in the last week of March. It responded that the prior ten calendar days (Mar10-24) had a very uncanny track record of forecasting the last week of March with those 2 time frames having a very strong NEGATIVE correlation which doesn’t bode well for next week given that March 10-24 was up 1.63% this year.

Note the 3-10, March 24-31 performance in the far right category below in those 13 prior years where March 10-24 was greater than 1.2% for an avg wkly loss of 0.74% with 1% moves 1-7 to the downside. This contrasts dramatically to the 11-2 performance when March 10-24 was less than -0.5%. Fingers crossed that it is wrong this year.

The outlook for April is much brighter.

Reference:

[ oftentimes true: ]

In Bull Markets, New Moons are Bottoms, and Full Moons are Tops.

In Bear Markets, New Moons are Tops, and Full Moons are Bottoms.

The SoLunar Rhythm in March 2024.

Labels:

Correlation,

Cup and Handle Pattern,

ICT,

Jeffrey A. Hirsch,

Power of 3,

Presidential Cycle,

Quarterly Theory,

S&P 500 Index,

Seasonality,

Solunar Rhythm,

Statistics,

Technical Analysis,

US-Stocks,

Wayne Whaley

Subscribe to:

Posts (Atom)

%20-%20ICT%20Syllabus%20for%20Beginners%20(YouTube).jpg)